Dividend Investment Calculator Contributions While Receiving Funds

Franked dividends are dividends or profits paid to shareholders by a corporation that has paid company tax in Australia on part or all of the profit being distributed as a dividend. To avoid the income or profit stream being taxed twice, the shareholder receives a franking credit for tax already paid by the corporation.A shareholder who receives a franked dividend is able to claim a tax offset for the franking credits, otherwise known as imputation credits, attached to the franked dividend. The franking credit represents the amount of company tax that has been paid.

- Calculator For Dividends Paid

- Dividend Reinvestment Calculator With Contributions

- Dividend Investment Calculator Contributions While Receiving Funds List

Calculator For Dividends Paid

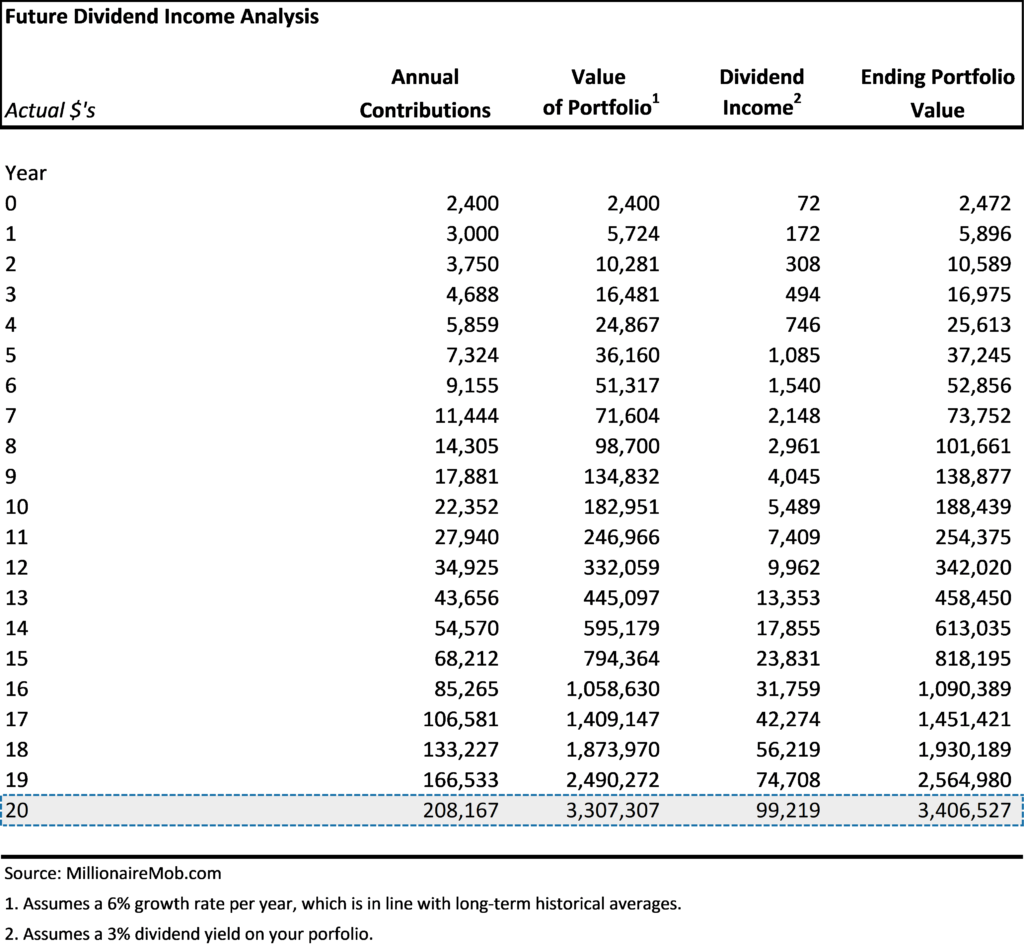

Dividend Investment Calculator. Use the power of saving, reinvesting, and time to create wealth. A few things to remember: Your rate of savings is likely more important than your rate of return.

Dividend Reinvestment Calculator With Contributions

Dividend Investment Calculator Contributions While Receiving Funds List

The corporate tax rate is currently 30%, or 27.5% for companies with a turnover of less than $25 million.If a shareholder’s marginal tax rate is less than the company tax rate of 30%, he or she would be eligible to receive a refund of the difference between the franking credit and the shareholder’s tax payable.Below are some of our key Franked dividends (and franking credits) articles.